One of the main reasons I write online is to document how I think during uncertain times, and right now, in early April 2025, things feel especially uncertain.

Every major headline points to chaos: a trade war with China, a sharp selloff in Treasuries, a volatile stock market, falling consumer confidence, fear of inflation, growing concerns of a recession etc. etc.

How can you make high-conviction investment decisions in this setting?

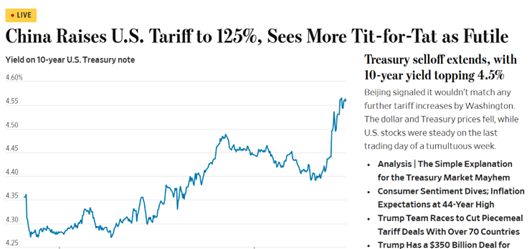

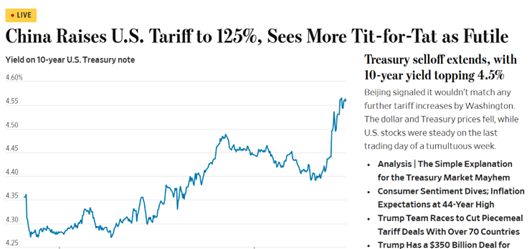

WSJ – 4/11/25

A lot of this noise, however, is just that – noise.

Yes, these issues matter, and it’s important to stay informed, but for long-term multifamily investors with a 5-10-year outlook, these short-term uncertainties shouldn’t be the driving force behind decision-making.

Here’s the backdrop for Atlas as I see it. We focus on acquiring high-quality, value-add multifamily investments in the Southeast:

Bottom line: I’m very bullish on Southeast multifamily over the next 5–7 years, and that hasn’t changed one bit over the past week.

That said, during uncertain times like these, investors often go looking for complex answers. I couldn’t explain the “treasury basis trade” to you, and honestly, I don’t need to. It really doesn’t matter to me.

I’ve said it before: Multifamily investing is a simple business that’s hard to execute well.

I have no idea what the near future holds, and honestly, anyone who claims they do is kidding themselves.

When I’m evaluating opportunities, I always come back to the fundamentals of multifamily investing:

It’s simple. But during uncertain times, when the best opportunities tend to pop up, it’s easy to overthink and talk yourself out of taking action.

Howard Marks said it well in his recent memo, aptly titled, Nobody Knows (Yet Again).

In my view, now is the time to act, not overthink.

The post Multifamily Real Estate Investing – Ignore the Noise and Focus on What’s Not Going to Change first appeared on A Student of the Real Estate Game.

Every major headline points to chaos: a trade war with China, a sharp selloff in Treasuries, a volatile stock market, falling consumer confidence, fear of inflation, growing concerns of a recession etc. etc.

How can you make high-conviction investment decisions in this setting?

WSJ – 4/11/25

A lot of this noise, however, is just that – noise.

Yes, these issues matter, and it’s important to stay informed, but for long-term multifamily investors with a 5-10-year outlook, these short-term uncertainties shouldn’t be the driving force behind decision-making.

Here’s the backdrop for Atlas as I see it. We focus on acquiring high-quality, value-add multifamily investments in the Southeast:

- Rental demand is booming. RealPage just reported the strongest Q1 for net absorption in over 25 years. The Southeast is leading the way, with markets like Dallas, Austin, Atlanta, Charlotte, Raleigh, Orlando, Tampa, and Nashville, and smaller markets in South Carolina and Florida, seeing the most activity.

- Resident retention is at a 3-year high, helping support strong occupancy.

- New supply is slowing down, and the 2-3-year supply outlook is as favorable as we’ve seen. Construction costs continue to rise, and that’s unlikely to change, regardless of what happens with tariffs.

Bottom line: I’m very bullish on Southeast multifamily over the next 5–7 years, and that hasn’t changed one bit over the past week.

That said, during uncertain times like these, investors often go looking for complex answers. I couldn’t explain the “treasury basis trade” to you, and honestly, I don’t need to. It really doesn’t matter to me.

I’ve said it before: Multifamily investing is a simple business that’s hard to execute well.

I have no idea what the near future holds, and honestly, anyone who claims they do is kidding themselves.

When I’m evaluating opportunities, I always come back to the fundamentals of multifamily investing:

- Buy below replacement cost

- Use long-term fixed-rate debt whenever possible

- Pursue deals with supportable value-add business plans and good downside protection

- Focus on strong physical and locational attributes, things like access to jobs, natural amenities, good unit layouts, functional spaces, and quality amenities

- Deliver what residents actually want: great value, a sense of community, and reliable service

It’s simple. But during uncertain times, when the best opportunities tend to pop up, it’s easy to overthink and talk yourself out of taking action.

Howard Marks said it well in his recent memo, aptly titled, Nobody Knows (Yet Again).

“There’s absolutely no place for certainty in the world of investing, and that’s particularly true at turning points and during upheavals. I’m never sure my answers are right, but if I can reason out what’s most logical, I feel I have to move in that direction.

The old saws that are the refuge of terrified investors – “we’re not going to try to catch a falling knife” and “we should wait for the dust to settle and the uncertainty to be resolved” – cannot in themselves be allowed to determine our behavior.

I love the title of a book by a market analyst named Walter Deemer: “When the Time Comes to Buy, You Won’t Want To.” The negative developments that make for the greatest price declines are terrifying, and they discourage buying. But, when unfavorable developments are raining down, that’s often the best time to step up.”

In my view, now is the time to act, not overthink.

The post Multifamily Real Estate Investing – Ignore the Noise and Focus on What’s Not Going to Change first appeared on A Student of the Real Estate Game.